Mark Carroll Financial Disclosure Report Reveals IRS Installment Plan to Pay Back Business Income Taxes Debt

Written by John Lopez

On Monday, May 23, after receiving a brief extension from the U.S. House clerk’s office, IL-11 congressional candidate Mark Carroll (R-North Aurora), who’s endorsed by Illinois Family Action, filed his Financial Disclosure report (FD) electronically with the U.S. House clerk. The report was visible to the public on Tuesday, May 24.

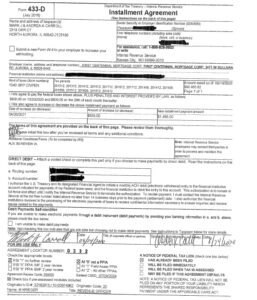

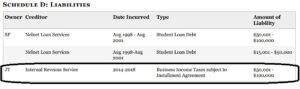

Upon reviewing Carroll’s report, a joint liability was found where Carroll and his wife had an approved IRS Install Plan for between $50K-$100K of unpaid business income taxes:

Given the significance of this kind of a debt to the Internal Revenue Service for a candidate pursuing a seat in the United States Congress for the 11th Congressional District, due diligence was applied by Illinois Family Action to ensure Republican primary voters receive the whole truth in the remaining 3 1/2 weeks of the primary campaign ending on June 28 in order to cast an informed vote.

Given the significance of this kind of a debt to the Internal Revenue Service for a candidate pursuing a seat in the United States Congress for the 11th Congressional District, due diligence was applied by Illinois Family Action to ensure Republican primary voters receive the whole truth in the remaining 3 1/2 weeks of the primary campaign ending on June 28 in order to cast an informed vote.

In order to apply full context to this story, Illinois Family Action reached out for specific information to ensure full disclosure about the facts behind the IRS back taxes owed by Carroll and his wife, and specific Installment Plan implemented and Carroll’s commitment to quickly eliminating the indebtedness to the IRS as quickly as possible.

Before continuing, here is a brief introduction to what an FD is from the House clerk’s office:

“Financial Disclosure Reports include information about the source, type, amount, or value of the incomes of Members, officers, certain employees of the U.S. House of Representatives and related offices, and candidates for the U.S. House of Representatives.

“These reports are filed with the Clerk of the House as required by Title I of the Ethics in Government Act of 1978, as amended. 5 U.S.C. app. § 101 et seq.

“Section 8 of the STOCK [Stop Trading on Congressional Knowledge] Act of 2012, as amended, requires the Clerk of the House of Representatives to provide online public access to financial disclosure reports filed by Members of Congress and candidates for Congress.”

It should be noted the disclosures through an FD filed with the U.S. House clerk (and to the U.S. Senate clerk for U.S. Senators and candidates) are in addition to the filings required under the Federal Election Commission (FEC) Act, and the quarterly FEC campaign disclosure filings for federal candidates and officeholders. Members of Congress must file an FD each year.

Full context of Carroll’s IRS liability begins with sharing the whole truth, so the business at issue here is the now defunct Carroll Law Offices, P.C. which was incorporated in 2007 and dissolved in early 2020. Here is the entry in the Illinois secretary of state (SoS) business website:

Carroll passed the bar for his Illinois law license in 2001.

Carroll passed the bar for his Illinois law license in 2001.

According to Carroll, here is what happened beginning in 2012, per prepared statement from the Carroll campaign Carroll shares the facts about why Carroll Law Offices, P.C. was delinquent to the IRS beginning in2012 through 2018, including the fiscal years when the tax delinquencies began.:

“The nature of my client base, was such that my pay was irregular and sporadic. There were several years where more than 60% of my total annual revenue came in the last quarter of the year. Unfortunately, this sacrifice often came at a cost to the bottom line and to my ability to support my family. When I could no longer bear the financial burden for my family, I turned my practice to in-house and was faced with the decision to wind down my law practice.

“I do not regret for one minute the time or effort I put into representing my private clients. It was a blessing to be able to serve them.”

Mark Carroll and his wife who’s also an attorney entered an initial voluntary Installment Plan with the IRS under Form 433-D in or around June 2017, which was later modified in or around March 2018, May 2019, and finally in August 2020.

Carroll provided the final redacted copy of the modified IRS Form 433-D to provide full context of the full liability to the IRS documented on the FD:

With the final IRS Form 433-D, the campaign explained Carroll’s commence of payments on the final Installment plan signed on August 24, 2020:

“Carroll has been making regular monthly payments since October 2020.

“The current monthly payment is $1,435.00 per month.

“The total IRS debt, including interest and penalties was in excess $89,465 in August of 2020.

“The remaining balance is $56,129.00”

The $56,129 remaining balance is reflected in the FD Schedule D above, within the $50K-$100K range reported on May 23.

Upon the release of his reports, Carroll added the following commitment to prevent the outstanding debt owed to the IRS from becoming an issue in the general election campaign, if he wins the Republican nomination on June 28:

“As for the repayment of the IRS balance, I [Carroll] am in process of refinancing our primary residence.

“The balance of the IRS debt will be paid in full out of the proceeds of the loan.

“The refinance loan should close in the next 30-45 days.

“However, I do not have control of the timing.”

As the timing of the loan to pay off the outstanding balance on the debt, currently at $56,129, Carroll plans to eliminate the debt some time in mid to late July.

Once the debt is eliminated, Carroll can then file an amended FD, with the debt owed to the IRS eliminated and no longer being an issue.

In his statement, Carroll made the following additions for the record:

“Shutting down my law practice was one of the hardest decisions I ever had to make. At the time, I was embarrassed and ashamed that I had failed to keep my law practice alive.

“Looking back, I am not ashamed or embarrassed. While in private practice, I was able to represent and serve over 1,500 clients, thaty were made up of small businesses, families and individuals. And by ‘small business’, I mean businesses with less than 20 employees.

“The overwhelming majority of my clients were not millionaires or large companies that could afford exorbitant legal fees. I was the first guy my clients called when they had a problem, and unfortunately, I was the last bill they could pay when they received their bills.

“My phone was never off and my door was never closed, the same as it will be if I am elected to Congress.”

Conclusions

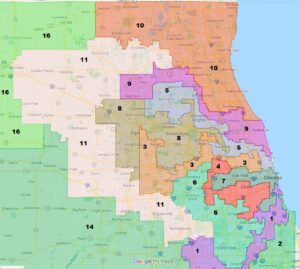

With the whole truth revealed for Carroll’s IRS Installment Plan, what are voters to do in the 11th Congressional District Republican primary?

Between now and June 28, Republican primary voters within the 11th Congressional District must weigh the truth of Carroll’s failed business within the context of life experiences.

Many a candidate with any amount of life experiences have something in their life that failed, or didn’t turn out the way one would have expected. Whether its a failed marriage, a failed business or not earning a post-graduate degree, everyone has come up short in something in their life.

Scripture teaches no one of this earth is perfect.

The issue of Carroll’s IRS debt and his plan to pay it back by the end of next month to eliminate it must be evaluated in the context of the entire Republican primary field seeking to challenge Congressman Foster this fall.

As said in a previous article, the FD is an excellent tool to vet candidates, and it can be pointed out even more through Carroll’s FD, which first alerted Illinois Family Action of his liability with the IRS.

An additional article concerning other parts of an FD not covered here is forthcoming to help Illinois Family Action readers make the most of the FD resource.

Within a calendar year, all congressional candidates who exceed $5K in campaign receipts and/or spending must file their FD by mid May, or within 30 days, whichever is later.

Carroll’s initial FD can be viewed here in its entirety.

The other Republican candidates’ respective reports can be viewed by clicking the link on their names:

- Jerry Evans of Warrenville

- Andrea Heeg of unincorporated Geneva

- Catalina Lauf of Woodstock

- Susan Hathaway-Altman of unincorporated Geneva

- Cassandra Tanner Miller of Elgin

Candidates Lauf and Tanner Miller have not yet filed their latest FDs due last month. Heeg has not raised/spent enough.

Something else to evaluate candidates for the primary, and that is the timely submission of an FD on the date its due, or within the boundaries of an extension. Because the primary election is now less than 30 days away, no FD filing extensions were granted beyond May 29.

John Lopez has written about policy and elections through the McHenry County Blog since 2019. He is now semi-retired, and does freelance work with analytics, as well as political candidates, emphasizing policy as the means to advance the conservative message, by engaging through policy “dog fighting”, applying discernment for winning and advancing God’s Kingdom agenda.

John’s known for getting past the talking points, the narratives, the abstracts, the platitudes and the bromides in order to discuss policy and apply Scripture to overcome unholy divisions in the local community, our state, and nation. John has been married for over 17 years.

Follow John on Twitter: @MarcVAvelar