For Honest Assessment of Chicago’s Financial Woes, Read Out-of-Town Papers

If you’re a close reader of the two Chicago metro dailies, you know both the Sun-Times and the Tribune are reluctant to talk much about Chicago’s dire financial situation. The one exception is when the union members in the press are trying to help the union candidate for mayor, Jesus “Chuy” Garcia. Then, they’re quick to point out that Rahm Emanual is a rich guy, who hangs out with other rich guys like Gov. Bruce Rauner.

It’s a shame the media’s inherent bias gets in the way of telling the truth about Chicago’s finances, because the city is in – to put it in terms even a kindergarten kid can understand – deep doo-doo. But to get the ugly details, Chicago taxpayers have to rely on national media outlets unbeholden to certain parts of the Chicago political machine. Cue a recent Wall Street Journal, and a story headlined, “For Some Bond Investors, Chicago Isn’t Their Kind of Town”:

A big pension shortfall is buffeting the Windy City. Fearing that the multibillion-dollar gap might undermine Chicago’s finances, some bond investors and credit-ratings firms are becoming wary.

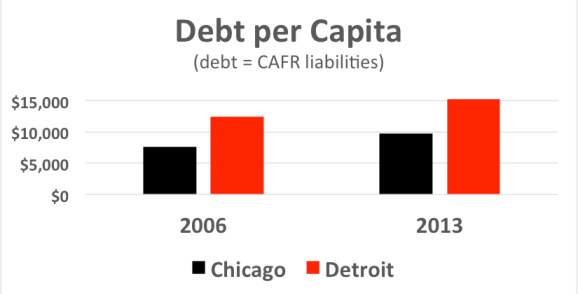

Four pension funds in the nation’s third-largest city are facing a combined funding gap of about $20 billion after years of underfunding and market losses during the recession. In comparison, Chicago has a $3.5 billion annual budget for general operating expenses.

Moody’s Investors Service cut the city’s credit rating in February to Baa2, two notches above junk status, and maintained a negative outlook. The firm warned that the city’s “highly elevated” unfunded pension liabilities could increase, “placing significant strain on the city’s financial operations.” Other ratings firms give the city higher grades.

The concerns come as an April 7 mayoral runoff election approaches, pitting Mayor Rahm Emanuel against Jesus “Chuy” Garcia, a county commissioner. The city’s finances have featured prominently in the election campaign.

That’s the ugly truth, up until that last paragraph. The press has mostly shied away from talking about finance specifics – including during Tuesday night’s final mayoral debate – because to do so would be to put their candidate, Mr. Garcia, who seems to have no specific answers, in a bad light.

To make matters worse, there is a real possibility that Chicago may have to pay higher interest rates to issue new bonds.

Three bond insurers, Assured Guaranty Ltd., National Public Finance Guarantee Corp. and Build America Mutual, already have backed billions of dollars combined of Chicago bonds and are at or near their limits for how much Chicago debt tied to property taxes they are willing to insure, said people familiar with the matter. An insurer agrees to make payments if the municipality defaults, so no insurance means Chicago would have to offer higher interest rates on any new bonds to compensate investors for the added risk.

And the bond market – beholden to no political interest except the all mighty dollar – thinks there’s more bad news to come.

In a statement, the mayor’s office said Mr. Emanuel has “worked to right the city’s financial ship.” The statement also said the mayor has been clear that “Chicago’s pension obligations were the biggest threat to the city’s financial security.”

Burton Mulford, a portfolio manager at Eagle Asset Management Inc. in St. Petersburg, Fla., said his firm has been staying away from Chicago bonds and is waiting until the pensions are in better shape.

“There’s going to be a lot more pain before there’s improvement,” said Mr. Mulford, whose firm oversees $2.2 billion in municipal bonds.

And, of course, that pain is going to be felt most by taxpayers, the innocents in all this. If any of them are still looking to the local papers for a blunt financial assessment of the city’s woes – regardless of who wins next week’s election – we’d advise them to look elsewhere.

But we’ll keep watching…and reporting.

This article was originally published on the IllinoisMirror.com website.