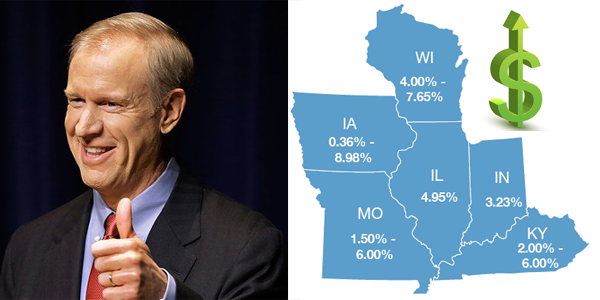

Rauner was For a State Income Tax Increase Before He was Against It

Written by John Biver

In this age of fake news it is problematic to cite big media reports as source material. Nevertheless, when State Representative Dave McSweeney says that Governor Bruce Rauner supported a tax increase if it was part of a “grand bargain,” then there is a good chance many of the links below are more factual than not.

Rep. McSweeney has been the most outspoken critic of Rauner of anyone in the General Assembly, and he didn’t wait for others to go public with their criticism — he led the way. As you can read here, McSweeney clearly outlined his complaint two years ago. Over at Illinois Review, in addition to endorsing Jeanne Ives for Governor, McSweeney said:

Governor Rauner showed his true colors by opposing the recently passed federal tax cut bill. It makes sense that Rauner opposes cutting federal taxes because he spent his first few years as Governor begging the General Assembly to raise the income tax by 32 percent under the guises of the “Grand Bargain” and the “Capitol Compromise.”

In order to sign the tax increase, Rauner wanted reforms such as workers comp reform and a property tax freeze. In his budget address back in February he did not rule out a tax increase.

Here are just a few articles that appear to back up Rep. McSweeney’s claim (there are many more out there):

Chicago Tonight, August 11, 2017:

His demands for making the workers’ compensation system more friendly to business, scaling back public employee pensions, legislative term limits and other changes that Democrats refused to approve kept Illinois without a budget for two years. The gridlock came to an end early last month when a dozen Republicans bucked their governor and joined Democrats to pass a spending plan and accompanying income tax increase.

Rauner, who is up for re-election next year, had openly supported a tax hike as long as it was accompanied by “reforms” but is now using his political war chest to campaign on an anti-tax platform.

The Rock River Times, July 12, 2017:

The shift is notable because for Republicans to win statewide in Illinois — a place that typically favors Democrats for those offices — candidates tend to run as moderates. Rauner himself said for years he would support a tax increase to help balance the budget, provided it was accompanied by pro-business changes such as lower workers’ compensation costs.

Chicago Sun-Times, July 6, 2018:

While the governor needs that cash flow to keep the state running, he’s targeting the speaker for the income tax hike — even though the rate was agreed upon by his own office and Republicans during budget negotiations. Both said they’d approve the hike if it was tied to a four-year property tax freeze.

Rauner, too, criticized the passage of a $36.1 billion spending plan, which he called “not balanced,” lacking in cuts and ignoring the state’s backlog. The governor said it lacks property tax relief and term limits — his two priorities going into his re-election campaign.

Fox News Politics, July 4, 2017

Rauner promised to veto the tax measure because Democrats who control the General Assembly have not agreed to resolve his pet issues, including statewide property tax relief, cost reductions in workers’ compensation and benefits for state-employee pensions, and an easier process for dissolving or eliminating local governments.

“It’s regrettable that I stand here today not capable of being able to support this package, not because what’s in the package is bad, but because it’s incomplete,” said the Senate’s newly minted minority leader, Bill Brady of Bloomington. “We need a comprehensive budget package with reforms.”

An Illinois Policy Institute op ed, June 29, 2017

A new poll shows Gov. Bruce Rauner’s political base opposes the tax hike budget proposal the governor has supported. And Illinoisans who favor the tax hike budget proposal do not support Rauner.

The political calculation behind Gov. Bruce Rauner’s embrace of the tax hike budget plan backed by certain Republicans in the Illinois General Assembly would seem to be one of self-preservation. The benefit of appearing to back a solution — even one with over $5 billion in economically damaging tax hikes — might seem to outweigh the risk of standing firm on pro-taxpayer principle.

Crain’s Chicago Business op ed by Rich Miller, May 26, 2017:

That’s important because Gov. Bruce Rauner has insisted that he won’t approve any tax hikes or a budget without a four-year property tax freeze. Democrats in the General Assembly, however, have resisted the governor’s freeze proposal. And the Senate Democrats last week went ahead and passed a budget with tax hikes without including Rauner’s freeze.

Crain’s Chicago Business, May 18, 2017:

Republicans had asked for more time to continue budget talks before Wednesday’s votes. Without their support, the Senate was unable to pass legislation imposing a two-year property tax freeze. Rauner has demanded a permanent property tax freeze as part of any budget that would raise the income tax.

Chicago Sun-Times, February 14, 2017:

Calling himself the “most frustrated person in the state,” Gov. Bruce Rauner on Tuesday offered a glimpse into his third budget address — saying he’ll try to push along the Illinois Senate’s “grand bargain” plan.

Noting the high-pressure stakes of the plan — which includes a temporary property tax freeze, an income tax hike and changes in pension reform — Rauner spoke on Facebook Live to urge senators to “stay strong and do the right thing for the long-term for the people of Illinois.”

Chicago Tonight, January 31, 2017:

Insiders who did not want to be named called the [Illinois Policy Institute budget proposal] “laughable” and not based in reality; even Rauner has said he’s open to a tax hike if he gets his way on some long-term changes. Most government watchdogs say it’s impossible for Illinois to get out of the budget mess absent both revenue increases and spending cuts.

IFI Worldview Conference Feb. 10th

IFI Worldview Conference Feb. 10th

We are excited about our annual Worldview Conference featuring well-know apologist John Stonestreet on Sat., Feb. 10, 2017 at Medinah Baptist Church. Mr. Stonestreet is s a dynamic speaker and the award-winning author of “Making Sense of Your World” and his newest offer: “A Practical Guide to Culture.”

Join us for a wonderful opportunity to take enhance your biblical worldview and equip you to more effectively engage the culture:

Click HERE to learn more or to register!